A Discussion of Future Trends and Their Influences on the Copper Strip, Sheet and Plate Industry Part 1 of 2

Copper Applications in Innovative Technology

Introduction | Miniaturization | Chip Technology | Chip Packaging | Foreign Markets | Internet | Phone, TV & PC | Part 2 of 2

Copper alloy strip is the base material for key electrical and electronic product components. Future trends and developments especially in the information technology industry can have a profound effect on the type, quality, and quantity of copper alloy strip manufactured and sold over the next five to ten years. This paper discusses some of these future trends Preface The transistor and the microprocessor are the most important inventions of the twentieth century. Great inventions revise civilization by erecting new institutions, establishing new industries, and revolutionizing work, and play. Think of the automobile and how it transformed modern life, from the creation of suburbs to the radical change in the way we view distance and time.

And like the automobile, a late 19th century invention that reached its zenith in the 20th century, the microprocessor is only now, at the end of this century, coming into its own. Its true impact will only be felt in the century to come.

The Industrial Revolution, which irrevocably changed the world, was set off by only a 50 times improvement in productivity - a leap so great that it completely changed society. By comparison, the microprocessor has improved its performance one thousand times in just twenty-five years. In other words, developers of the microprocessor have accomplished the equivalent of the Industrial Revolution every two-and-half years. The latest generation of microprocessors already has 100 times the computing power of personal computers of just ten years ago. That is why things are changing so fast around us. And that is why the microprocessor is so important: it is the invention that will change the world.

Introduction

According to a study based on US commerce Department data and sponsored by the American Electronics Association and the Nasdaq stock market entitled "Cybernation: The Importance of the High-Technology Industry to the American Economy", sales by the computing and telecommunications industries have grown by 57 percent during the 1990s, to $866 billion, making those businesses an increasingly important force in the nation's economy. The study concluded that the field of information technology - often defined as both computing and telecommunications - is the nation's largest industry, ahead of health services ($818 billion), construction ($569 billion), and food products ($464 billion). Global Spending on information technology is expected to maintain an annual growth rate between 8 and 12% for the next several years.

BBF & Associates' recently updated market study of copper usage in electronic connectors demonstrates that the market for copper alloys for connectors continues to be dynamic and rapidly growing. Sales of all types of electronic equipment are growing at annual growth rates in the range of 15 to 20%. Copper alloy usage (including scrap) in the electronics market will grow approximately 17% over the next 5 years from 238 million pounds in 1995 to 351 million pounds in 2000. Personal computers will continue to provide much of the growth for connectors and interconnection devices in spite of the trend towards miniaturization. Foreign markets will play an increasingly important role in PC growth over the next several years as they attempt to improve automation, communication and productivity.

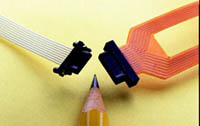

Miniaturization

Trend: Further miniaturization in electronic connectors is planned (more average contacts in smaller sizes - and related reduced copper content per contact) for many newer designs. The driving force is the economics of many of the consumer, communications and related applications, and the need for smaller sizes for related electronic equipment for many newer applications.

Trend: Further miniaturization in electronic connectors is planned (more average contacts in smaller sizes - and related reduced copper content per contact) for many newer designs. The driving force is the economics of many of the consumer, communications and related applications, and the need for smaller sizes for related electronic equipment for many newer applications.

This miniaturization has meant that far less copper strip products are required to carry the signal between components. However, the growth in sales of electronic equipment has more than offset the losses resulting from miniaturization. Copper and copper alloy consumption in electronic interconnect products has increased from 155 million pounds in 1985 to 238 million pounds in 1995. Copper alloy consumption is continuing to grow, albeit at a slower rate than for electronic component production and sales. It is reasonable to assume that these two competing effects will be in place through the next decade.

Impact: Assuming no other changes in consumer demand and technology, copper alloy strip consumption in electronic applications should reach between 351 and 403 million pounds by 2007.

This prediction assumes compounded annual growth rates of 3.3 (BBF & Associates estimate) and 4.5% (historical rate for the last 10 years) respectively, for copper alloy strip used in electronic connectors.

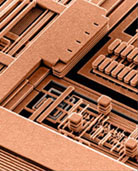

Chip Technology

Trend: Both IBM and Motorola recently announced the replacement of aluminum with copper in their chip manufacturing process. Actual effect on the worldwide consumption of copper is negligible.

Trend: Both IBM and Motorola recently announced the replacement of aluminum with copper in their chip manufacturing process. Actual effect on the worldwide consumption of copper is negligible.

This chip technology makes computers faster, and bring high-end computing power to portable devices. Copper's superior conductivity within the IC will permit the device to operate at a modest 1.8 volts, thus making these chips ideal for battery-operated portable electronic products due to their inherent low consumption of power. Over time, copper is expected to be the predominant metal used in high performance integrated circuits.

Impact: While the impact of the interconnects is not expected to influence the copper consumption, the decrease in operating voltage could influence the selection of the leadframe alloy.

Low voltages would inherently produce cooler chips resulting in a decreased need for high temperature resistant leadframe alloys.

Given that this new copper IC technology will disseminate throughout the semiconductor industry in ten years time, then the overwhelmingly predominant alloys for this market would change from C19400, C19500, C15500 and C15100 to C10200 and C11000. With lower voltages and hence, lower operating temperatures, there would no longer exist a need for high temperature softening resistance. Conductivity, solderability, and cost would be the primary considerations.

Chip Packaging

Trend: Connector manufacturers expect additional emphasis on surface mounted and selected other new packaging technologies representing potential labor cost savings in equipment production and future maintenance, and savings in "real estate" required for a given job.

Trend: Connector manufacturers expect additional emphasis on surface mounted and selected other new packaging technologies representing potential labor cost savings in equipment production and future maintenance, and savings in "real estate" required for a given job.

Two of these new packaging techniques are Ball Grid Array (BGA) packaging and multi chip modules (MCM).

Ball Grid Array (BGA) packages are satisfying many needs in the marketplace. These include support of high frequency I/O products for the SRAM (Static Random Access Memory) market, high I/O counts for the ASIC (Application Specific Integrated Circuit) and microprocessor markets, and lightweight, robust packaging for the portable market.

Due to a need for impedance control, there is a migration from leadframe containing packages toward the leadframeless packages. The driving force is continuing trend toward higher frequency operations in order to enhance the chip's processing speed.

Presently, the total leadframe market size is about 56 million pounds, with copper alloys enjoying about 22 million pounds of that total. BBF & Associates expect the leadframe market for copper alloys to grow at an annual compounded growth rate of 9% leading to about a total market size of 158 million pounds and a copper alloy market segment of about 62 million pounds by 2007. However, this assumes that integrated circuits will continue to employ older packaging techniques such as PQFP that use leadframes.

Impact: IBM predicts that these newer IC packaging technologies will receive widespread usage in the future. If their forecast proves accurate, then the leadframe market could conceivably decrease to essentially zero.

Foreign Markets

Trend: Foreign markets are growing substantially, and many users in those markets prefer suppliers to be nearby for faster response and availability with the products and designs required.

Trend: Foreign markets are growing substantially, and many users in those markets prefer suppliers to be nearby for faster response and availability with the products and designs required.

Many firms indicate increased interest in these growing electronic connector and related equipment markets in foreign countries, indicating trends toward increased plant locations in foreign countries to serve these growing markets, as well as to achieve competitive manufactured costs for their products. Many electronic connector manufacturers indicate that selected connectors are produced in these foreign subsidiaries, while additional connectors may be supplied from US facilities for many of these markets.

This trend toward increased plant locations in foreign countries to locally serve the customer is filtering down to the material supplier, e.g., the brass mills. Multinational companies are expanding their marketing reach particularly in the more rapidly growing regions of the world such as the Far East. Many firms are forming strategic alliances, consolidating, acquiring, and/or building new production facilities to maintain their competitiveness in these growing markets.

Impact: Corporations unwilling or unable to expand their horizons past the mature markets (North America and Western Europe) will not participate in the explosive growth of consumer electronics by means of supplying these new and yet to be built connector manufacturing facilities.

Internet

Trend: "Like the PC, the Internet is a tidal wave. It will wash over the computer industry and many others, drowning those who don't learn to swim in its waves." Source: Bill Gates, "Never Underestimate the Power of the Internet," The New York Times, August 1995.

The Internet's dramatic growth is continuing, according to a new survey, which estimates that the number of host computers permanently connected to the network reached 26 million in September. The survey, conducted by Christian Huitema, chief scientist in Bellcore's Internet Architecture Research Laboratory, shows that the number of host computers grew to 26 million as of Sept. 8, from 14.7 million a year earlier.

Impact: the driving force behind the high growth rate in personal computers, telecommunications, data communications, and now consumer electronics through a trend towards platform convergence.

Phone, TV & PC

Trend: Currently, these three high-volume electronic products (telephone, television, and personal computer) are making a fundamental transition from the analog world to the digital world.

Trend: Currently, these three high-volume electronic products (telephone, television, and personal computer) are making a fundamental transition from the analog world to the digital world.

Three ubiquitous communication interfaces have developed in this century: the telephone, the television, and the personal computer.

The television, telephone and PC platforms were each uniquely designed for particular content. All content will converge into digital streams of information that can represent text, graphics, audio, and video, and can be distributed over multiple media such as satellites, CDs, cable lines, and phone connections.

Consumer manufacturers will be introducing a host of new products: DVDs (Digital Video Disk), digital cameras, PDAs (Personal Digital Assistants), digital satellite decoders, Internet TV, and Intertext TV. The TV will be reborn as a new display device, a cross between a computer monitor and TV screen. High capacity DVD-ROM drives with backward capability to CD-ROM will be available. The consumer PC battle moves from the home office to the living room. The computer industry's long-planned invasion of the consumer electronics market has begun.

What's driving the convergence is market maturity, not customer demand. The television makers have just run out of new customers and want to sell everyone a new TV. The telephone companies already have every potential customer signed-up and need new services to fuel continued earnings growth. Broadcast and network equipment manufacturers want to sell updated equipment to their existing customers. And the PC industry, having penetrated 40 percent of American homes, needs new customers, even if those customers don't know what to do with a PC.

Convergence of these three consumer platforms has the potential for selling virtually each home in the US a new television in addition to some other consumer electronics such as a high speed modem and possibly a DVD player over the next 10 years. Over this timeframe, HDTV alone has the potential for selling 100 million units in the US alone.

Impact: These new consumer items are typically not included in most market studies on future connector usage as it is difficult to predict the consumer's acceptance. New products about to be introduced have the potential for being the next gigantic commercial success similar to the PC and portable telephone. A single product of this enormity has the potential to increase the copper alloy usage beyond present predictions by a margin that is virtually impossible to predict.

Part 2 of this report covers the following topics:

- Personal Computers

- Automotive Applications

- Wireless

- Smart Cards

- Coinage

- Copper-Nickel Sheathing

- Bismuth

Also in this Issue:

- Electric Vehicles

- New Research Program Focuses on Improvements for the 21st Century

- A Discussion of Future Trends and Their Influences on the Copper Strip, Sheet and Plate Industry Part 2 of 2

- A Discussion of Future Trends and Their Influences on the Copper Strip, Sheet and Plate Industry Part 1 of 2

- Copper Motor Rotors: Application of High Temperature Mold Materials to Die Cast the Copper Motor

- CDA Backs DX Geothermal Heat Pump R&D