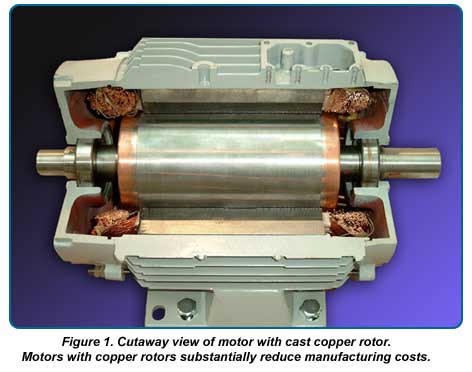

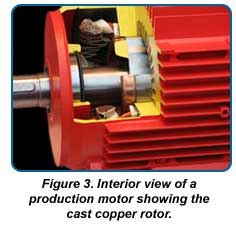

Update readers know that simply substituting copper for aluminum in electric motor rotors can either: (a) increase electrical efficiency when motors are held at the same size, or (b) reduce size and weight when horsepower and/or efficiency are held constant. For example, Update recently reported that several motor manufacturers who directly substituted copper for aluminum saw significant increases in efficiency in an agricultural irrigation application (See Update, October 2004). Designers can also trade off efficiency, size and power against each other to optimize motors for given applications.

But what about cost? What do copper-rotor motors cost to produce on a commercial scale? More to the point, how will the cost of "copper" motors compare with those of equivalent aluminum-rotor motors in mass production?

We already know that a straight one-for-one substitution of copper for aluminum shaves production costs by between four and seven percent, thanks mainly to the shorter lamination stack often possible with copper. That's encouraging but not compelling, because simply substituting copper for aluminum without redesigning the motor doesn't take full advantage of copper's benefits. In fact, motors for some applications cannot benefit from a direct substitution of copper, unless they undergo redesign as well. Also, direct substitution doesn't provide a fair comparison, because it creates motors that are merely similar but not functionally equivalent.

A rigorous comparison of production costs for truly equivalent motors is obviously the key issue here. Copper's advantages, clear as they are, would find few champions, if high production costs priced copper motors out of high-volume markets.

But now there's good news

A study conducted for the Copper Development Association Inc. (CDA) by Dr. Edwin Brush of BBF & Associates, Weston, Massachusetts, compared the actual cost of commercial-scale manufacture for EPAct/EFF-1-compliant general purpose motors with die-cast copper rotors with costs for "industry equivalent," mass-produced, aluminum-rotor motors with similar operating characteristics and efficiencies. Industry equivalent motors are composites constructed from information supplied to BBF & Associates by six major motor manufacturers. They were used in place of actual motors to protect the confidentiality of manufacturers' cost information, but participating manufacturers agreed that the composite motors described closely represent actual commercial-scale motor production costs.

The result of the CDA/BBF study: The motors with copper rotors cost less to produce, by far!

How much less? An average 18% (or $60) less for a 7.5-hp motor and 14% ($64) less for a 15-hp motor! The cost data are broken down in Table 1.

The numbers speak for themselves, but the following information may be helpful when interpreting the data:

- The copper-rotor motors were specifically designed to optimize the use of copper and, at the same time, be equivalent to (i.e., able to compete with) commercial aluminum-rotor EPAct/EFF-1-compliant motors in terms of efficiency and performance. Designs optimized for the copper motors incorporated modifications of such elements as slot design and placement, the number of teeth, stack height, gap width, shaft and bearing characteristics, stator laminations and stator winding configurations, stator winding weight and frame size. We'll return to that last design element in a moment.

- "Efficiency" refers to electrical energy efficiency as measured according to IEEE Standard 112-B. "Performance" factors include horsepower, inrush current, starting torque and slip.

- The industry equivalent 15-hp motor has an electrical energy efficiency of 91.1%, which complies with the European EFF-1 standard and is slightly higher than the minimum EPAct minimum value (91.0%) listed in Table 12-11 of NEMA MG 1-1998 R3. That puts it within the range of efficiencies guaranteed for currently produced EPAct motors of this size.

- Likewise, the industry equivalent 7.5-hp motor has an electrical energy efficiency of 89.6%, which satisfies the requirements of the EFF-1 standard and slightly exceeds the EPAct minimum efficiency, 89.5% in this case.

- Costs for steel and magnet wire provided to BBF & Associates by the various manufacturers take into account economies available through bulk purchase and long-term contracts. Steel costs are based on as-purchased weights between 130% and 140% of finished weights, to account for stamping losses. Steel costs also include stamping costs, die amortization and direct burden (materials and labor). Magnet wire costs refer to the direct weight of wire used in the motor.

- Rotor costs include the cost of base metal (copper or aluminum) plus direct die-amortization and melting costs. Many manufacturers hedge their base metal purchases to control costs.

- Shaft/housing/assembly costs include the costs of metal and fabrication plus a burden to account for plant overheads, including charges for plant amortization, return-on-investment and related items. A composite figure was used to construct the "industry equivalent" for these data, as well.

- Individual manufacturers' estimates for total labor content in a 15-hp motor ranged from 2.9 h to 3.3 h, including all processing from component fabrication through final motor assembly and inspection. Assembly itself might consume as little as 15 min depending on the degree of automation practiced by the manufacturer.

What's the bottom line? Look at all the costs

In both motor sizes examined, the costs of the copper rotors were approximately three times higher than those of the conventional aluminum rotors. That's not surprising, considering the difference in the metal's base cost and the fact that copper's significantly higher melting temperature means it requires more energy for processing. But higher rotor costs are no cause for concern, because the cost of the rotor comprises less than five percent of the total motor cost in a copper-rotor motor and only a bit more than one percent for a motor with an aluminum rotor.

In both motor sizes examined, the costs of the copper rotors were approximately three times higher than those of the conventional aluminum rotors. That's not surprising, considering the difference in the metal's base cost and the fact that copper's significantly higher melting temperature means it requires more energy for processing. But higher rotor costs are no cause for concern, because the cost of the rotor comprises less than five percent of the total motor cost in a copper-rotor motor and only a bit more than one percent for a motor with an aluminum rotor.

What is important is the effect the choice of rotor material has upon other cost elements. Using copper reduces the cost of lamination steel. That's because the stack can now be shorter, and, due to copper's high conductivity, use of a slot starter bar recovers any lost torque. Also reduced are the combined costs of shaft, housing and assembly, which are lower because the rotor itself is smaller.

- In the 15-hp motor, copper reduced the cost of lamination steel by $43 (19%) and a lowered the cost of the shaft, housing and assembly by $26 (15%).

- Corresponding savings in the 7.5-hp copper motor include $33 (21%) lower steel costs and $21 (15%) lower costs for shaft, housing and assembly.

Of particular importance in the case of the two motors studied is the fact that the use of copper in these optimized motors allowed a reduction in frame size. It is this change that brought about the double-digit cost reductions seen in the study. Previous analyses found that copper rotors reduced costs by between four and seven percent, mainly because copper rotors can often utilize a shorter lamination stack. (In some - but not all - cases, stack height can be shortened without modifying slot design while still maintaining adequate starting torque.) However, if design requirements permit a reduction in frame size while maintaining equivalent efficiency and performance, savings will more than double - moving to 14%-18% from 4%-7% (for only substituting copper in the rotor).

What does this mean to you?

The CDA-led development of a cost-effective process to manufacture copper-rotor motors began less than five years ago. The process, now patented, has been placed in commercial-scale production by motor manufacturers in Europe and Asia (see Update, March 2004, October 2004), mainly to improve efficiency in special-purpose applications. That "limited-production" barrier has now been cast aside. Copper can improve motor characteristics and efficiency and significantly reduce manufacturing costs even for the sort of mass-produced, general-purpose motors that make up the bulk of global motor production.

The CDA-led development of a cost-effective process to manufacture copper-rotor motors began less than five years ago. The process, now patented, has been placed in commercial-scale production by motor manufacturers in Europe and Asia (see Update, March 2004, October 2004), mainly to improve efficiency in special-purpose applications. That "limited-production" barrier has now been cast aside. Copper can improve motor characteristics and efficiency and significantly reduce manufacturing costs even for the sort of mass-produced, general-purpose motors that make up the bulk of global motor production.

Based on "real world" examples, copper motors cost less and perform better than aluminum motors, period. There could not be a stronger incentive for motor manufacturers to adopt the proven CDA technology in their product lines.